Seven Standen

A few years ago, the fashion and cosmetic retailer ASOS was absolutely everywhere. The black and white packages – in which products were mailed – became a symbol of the fashion-focused elite among young people.

Due to the growth of online shopping and the retailer’s ability to capitalise on it, ASOS quickly became one of the most popular e-commerce stores. Now, the rapidly dropping revenues and decreasing customer numbers could result in the end of this online fashion giant, posing the question: What does the rise and fall of ASOS teach us about fashion in the internet age?

The rise of ASOS

The company was founded in 2000 and was primarily aimed at young adults.

Originally, the site exclusively sold imitations of clothing and customers were able to filter products by actors they wanted to look like. In fact, the acronym ‘ASOS’ stands for AsSeenOnScreen.

On the front page, ASOS advertised their clothing by comparing it to Madonna’s, Zoe Ball’s, and those worn in Pulp Fiction. The same year it was founded, ASOS’s website won the Trendsetter Category of The Sunday Times’s Websites of the Year. Setting the precedent for their quick success, the retailer hit the ground running.

“By marketing explicitly to young people, ASOS captured the majority of UK shoppers who bought clothes online instead of in-store.”

Two decades later, ASOS was a global success story, selling over 850 brands (alongside their own) and shipping to 196 countries.

A distinct reason behind their triumph was the store being the first online retailer to make free worldwide shipping and free returns available to customers. By marketing explicitly to young people, ASOS captured the majority of UK shoppers who bought clothes online instead of in-store.

Although the store didn’t focus on selling imitations of celebrity looks anymore, it still centred around the latest trends and allowed young adults to ‘keep up’ with friends, fashion, and influencers.

The dramatic downfall

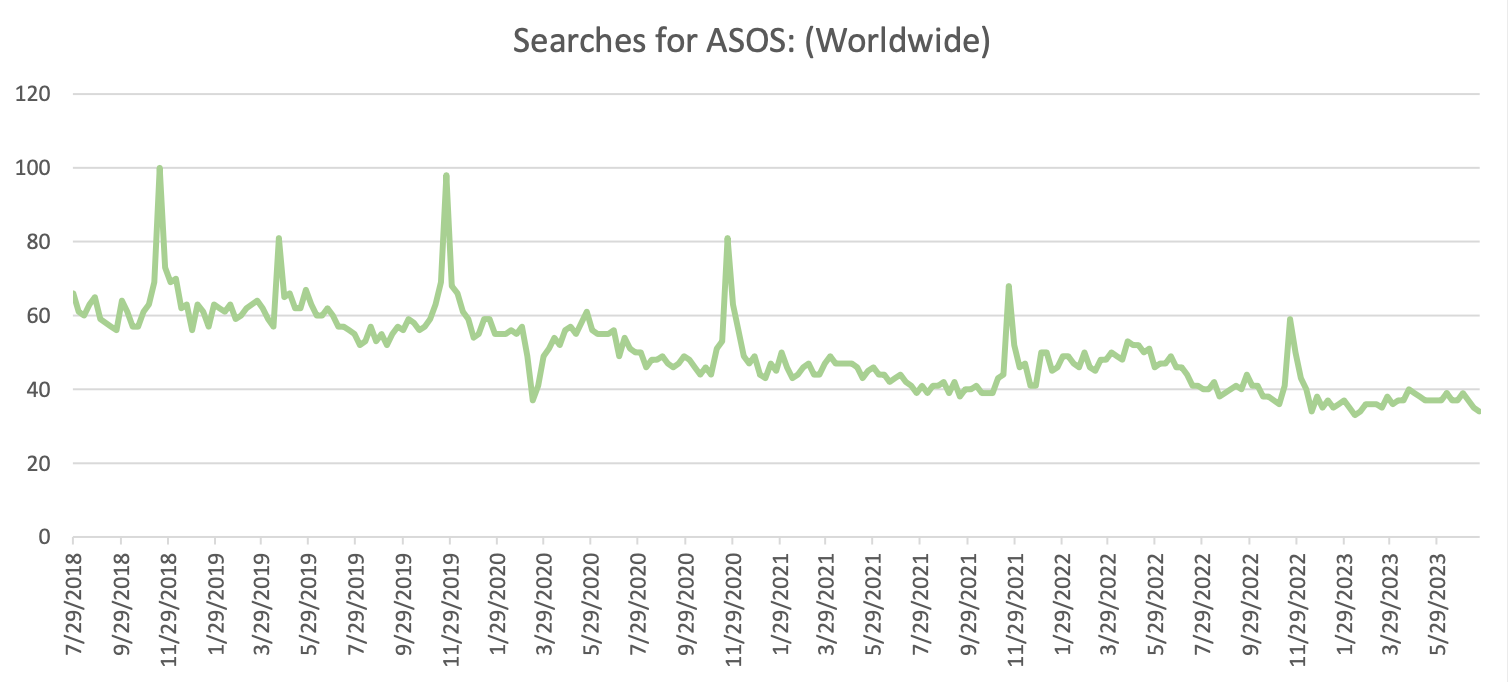

Despite ASOS dominating campuses, high streets, and offices for the last few years, it has gradually faded into the background. After a brief surge in pandemic popularity – which cynics would call ASOS’s final gasp for air – other clothing stores began to overtake them in both customers and sales.

By May 2023, the fashion retailer experienced a massive drop in sales and was predicting a ‘low double digit’ sales decline in the second quarter of the year. Supply chain issues, high competition, and the cost of living crisis were all blamed for the seemingly sudden decline of ASOS.

Many experts predicted that the sales slumps signalled the end of this e-commerce giant.

But CEO José Antonio Ramos Calamonte refused to lay down and accept it, saying: “I am very confident of our return to sustainable profit and cash generation.” Last year, he announced a dramatic overhaul of ASOS’s current business model, no doubt recognising that the fashion retailer was struggling to compete.

Although, the ‘sudden’ fall of ASOS wasn’t as unexpected as customers might think.

Time to grow up

Refusing to broaden the store’s horizons and grow with its customers is one of the reasons ASOS is being eclipsed by other e-commerce retailers. ASOS focuses exclusively on young people, selling products from New Look, Miss Selfridge, and Topshop. This strategy assumes those who ‘age out’ of their clothes will be replaced by fresh-faced teenagers. But with original customers from the 2000s now in their thirties and forties, ASOS needs new ones.

However, there has been a dramatic shift in online fast fashion.

Internet store Shein has become one of the most popular clothing retailers and now claims most of ASOS’s market. Shein produces masses of products (over 9000 new ones a day) based on what fashion trends their algorithm predicts. The company uses real-time information to see how well each item performs, functioning on a model of reordering successful products, and discontinuing unsuccessful ones. This supercharged fast fashion model guarantees that Shein remains popular among their young customers who are constantly chasing the latest trends.

“impossible for the company to compete”

With competitors like Shein snapping up the youth market and producing clothes faster and cheaper than ASOS, it seems impossible for the company to compete.

Could ASOS be revived?

Since the business nearly collapsed in May, ASOS has attempted to encourage customers to return to their online store. In early July, they launched a ‘sample sale’ where every product cost £5, in an effort to reduce excess stock.

“it’s hard to see much of a future for ASOS”

More recently, ASOS attracted attention online for launching a range of outfits for wedding guests. This divided shoppers’ opinions about whether or not the clothes were appropriate to wear at a wedding – although, as everyone knows, all press is good press when it comes to promoting your brand.

https://www.tiktok.com/@summerjadestyle/video/7231820366543457563?q=asos%20wedding%20guest%20&t=1690976051274

Despite this, it’s hard to see much of a future for ASOS. The reason for their early success was because, at the time, the retailer was selling clothes in a unique and cost-savvy way that benefitted consumers. While most high street stores found it difficult to move to online shopping, ASOS was ahead of the game and knew how to capture its audience.

“While ASOS still has customers, they have little reason to remain loyal to the brand when other places have better deals and practices.”

However, ASOS no longer has anything to offer that other stores aren’t doing better. Fast and cheap shipping has become the norm, especially with stores like Shein and Amazon. Nearly every store now also offers free and easy returns, something that was once one of ASOS’s unique features.

While the store’s original niche of helping teens dress like celebs was interesting, ASOS has since dropped this part of their model and is now just like any other online fashion retailer.

Young people are becoming more climate-conscious and less interested in fast fashion. Most people wanting to buy secondhand poses a problem to ASOS. While it does have a marketplace, ASOS mainly features ‘vintage’ stores. The prices are hardly cheaper than buying firsthand, which doesn’t compare to independent sellers on Depop or Vinted.

Looking ahead

ASOS customers have little reason to remain loyal to the brand, especially when other places have better deals and practices.

Compared to just five years ago, ASOS’s presence among young and trendy people has virtually disappeared. It’s difficult to find anyone who relies on ASOS or considers it their go-to retailer. The iconic black and white packages, which used to be on most porches or doorsteps, are an emblem of the recent past. It belongs to a different era now.

ASOS might stick around. But it doesn’t have the same status as it did a decade ago.

READ NEXT:

-

ARE CROCS FASHIONABLE NOW?

-

THE REALITY OF TRYING A DOPAMINE DETOX

-

THE EVER-LASTING POWER OF THE TOTE BAG

Featured image courtesy of Amanda Vick on Unsplash. No changes made to this image. Image license is here.